It is hardly a secret that Americans seem to thrive on debt. According to https://www.forbes.com, the US credit card industry continues to grow steadily and has been reported to reach $1.04 trillion in Q3 2018. Many cardholders find it extremely difficult to keep track of multiple credit cards and as a result, even if they have the cash, often fail to make the monthly payments by the due dates. Missing due dates not only adds stiff late payment charges to the dues but also increases the interest payable and more often than not, cardholders land up in a debt trap. If you are one of those, who are tired of tracking multiple credit card statements every month and remembering to pay by the due dates, then credit card consolidation may just be the thing that can get you out of the mess. You can visit somewhere like SoFi to find out more about credit card consolidation loans and their various options.

What Is Debt Consolidation

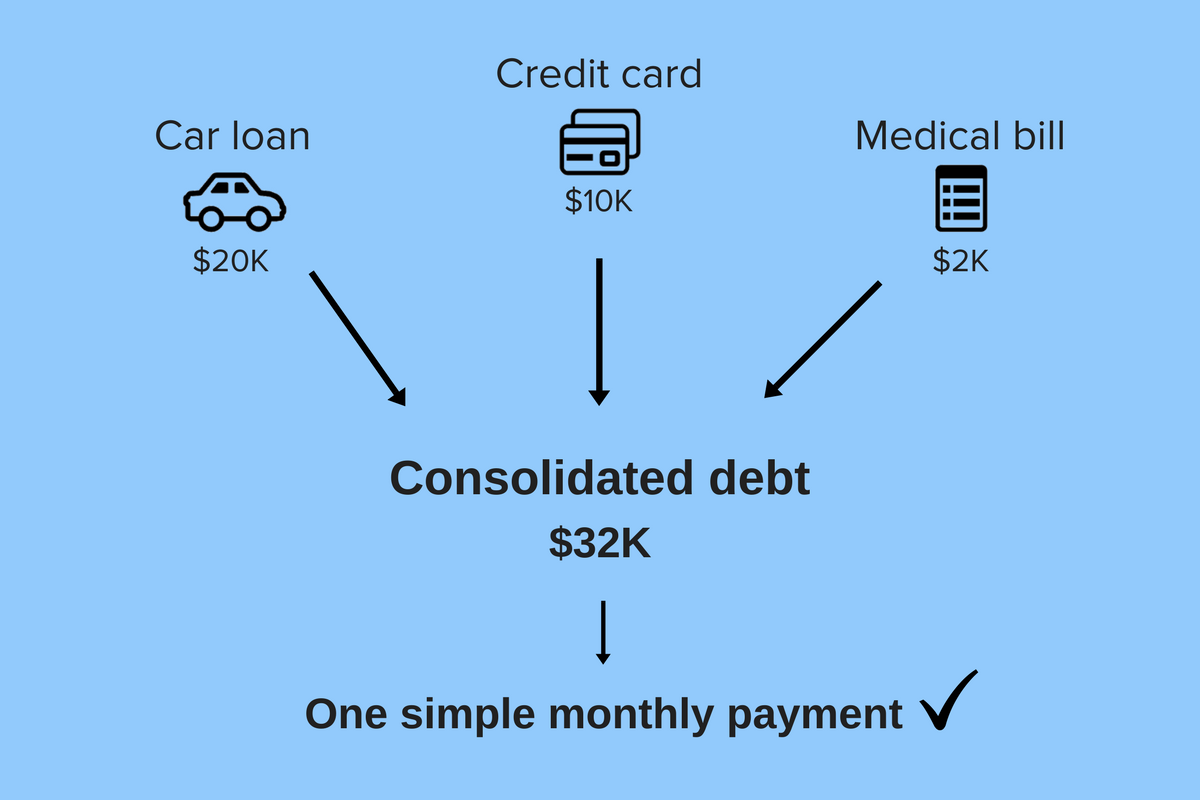

Debt consolidation is a simple process of aggregating all your individual card dues and taking out a new loan with which to repay the credit cards in full. By doing this, you eliminate all the individual debts and instead, have one single large debt to repay. If you had been expecting a reduction in the amount of the debt, this might come as a disappointment; however, debt consolidation has a unique bunch of benefits that makes it very appealing.

Benefits of Debt Consolidation

No more stress of tracking multiple credit cards: The first and foremost advantage of undertaking a debt consolidation is that you will have eliminated all your individual credit card dues and freed up your credit limits. This makes the tracking of a large number of monthly statements and the need of making individual payments by the due dates redundant. You only have one debt to take care of and one monthly payment to be made so this takes a lot of stress off you.

Repair damaged credit report: The other important benefit is that even though the new loan can cause your credit score to dip, the freeing up of the credit card limits on the individual cards minimizes the credit utilization ratio, which is a very important parameter of calculating the credit score, and enables you to improve your credit score over time.

Save on the interest expense: Credit card interest rates are notorious for being extremely high so if you have a decent credit score, you will usually be able to find a debt consolidation loan at a substantially less rate of interest, so the amount of interest that you can save can be really substantial over a period of time. If you have taken a balance transfer at a zero percent rate of interest, the savings can make the consolidation really worthwhile.

Make the monthly payment more affordable: When you take a debt consolidation loan, you will usually be able to negotiate a longer repayment period if you wish and that will make the monthly loan repayment amount more affordable. With the savings that you can make by making budgets and lifestyle changes and the lesser interest payment, you can repay the loan more quickly and free yourself from the crushing burden of debt.

Options for Consolidating Debt

You can consolidate debt in a number of ways, but because each method has its own pros and cons, you should carefully consider each option to find out which one works the best for you. There is no universally best debt consolidation method; however, the following are the most popular:

Work with a credit counseling organization: By working with a credit counseling organization, you can get valuable advice on how to manage your finances better and pay off your debt. Try to identify a non-profit that is accredited to the National Foundation for Credit Counseling (NFCC). It may be possible for you to be able to set up a debt management plan that involves making a single payment to the counseling company who then takes the responsibility of paying off the card companies. While sometimes, you may be able to get the benefit of lower rates of interest, the counseling company may charge fees as well as require you to close all the credit cards. See debt settlement ratings online for the most popular counseling agencies.

Take a debt consolidation loan: This is essentially a personal loan that you take from a bank, credit union or more typically, a private lender specializing in this activity with which, you pay off all your credit card dues. You can save substantially on the interest if you have a good credit score and extend the repayment period to make the monthly payment more affordable. You need to be alert of companies who try to rip you off with high rates of interest and/or a variety of fees that can make the loan expensive. Always remember to shop around before taking out a loan of any kind in order to get the best deal for you and your finances.

Avail of a credit card balance transfer offer: Credit cards often offer good customers balance transfer facilities usually at a zero percent rate of interest. You can sweep all the dues of the other cards into the new card and enjoy a period of 12-18 months when no interest is payable on your dues. For best results, you should pay off all your dues with the introductory period. However, balance transfer fees, if charged, will reduce your saving. Also, the credit limit of the new card may not be able to accommodate all the dues of the other cards.

Borrow from your retirement account: Taking a loan from your retirement account is easy because there are no credit checks, and you may not even have to pay any penalties for early withdrawal under some situations. However, the retirement account gets depleted, you are usually liable to pay penalties for early withdrawal and you generally need to repay the amount within five years of borrowing it.

Conclusion

As a method of getting back control over your finances, debt consolidation is easily one of the most attractive. While there are a number of different methods of accessing the necessary funds, you will need to find out which one is the most suitable for your circumstances. Regardless of the method adopted for debt consolidation, it can be a good idea to ensure that you make the necessary lifestyle changes.